How to Check My Credit Report

“How can I Check My Credit Report? It’s so overwhelming” is a statement I get to hear too often. Because your credit report and credit score are critical to your financial well-being, it’s important to understand exactly what the terms mean.

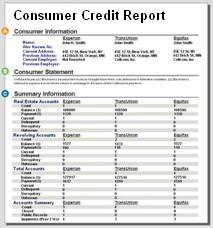

“How can I Check My Credit Report? It’s so overwhelming” is a statement I get to hear too often. Because your credit report and credit score are critical to your financial well-being, it’s important to understand exactly what the terms mean.This section walks you thru the task of reading a credit report, explaining each and every part of the your credit report, what it means, what type information may be included in it and how it affects your credit rating. A sample 3 in 1 credit report is included for your convenience.

Many people alleviate the importance of thoroughly checking their credit report. This is a big mistake.

First, your credit score is based on your credit report. Any incorrect information can potentially reduce your credit score. Lower credit score means higher interest rates and monthly payments, or even worse – you could be denied of credit, loan or a job altogether!

Second, a credit report is often the first place people detect identity theft or credit fraud.

According to a study done by U.S. PIRG, up to 79% of all credit reports contain errors of some kind. With that in mind, it is imperative that you take this task very seriously.

How to Read and Check My Credit Report

Errors are much easier to detect on a 3-in-1 credit report than on a single bureau credit report because they tend to stand out. Scanning and comparing the information from the 3 major credit bureaus is very easy when data from each credit bureau appear side by side.

Another benefit of the 3 bureau online credit report is that it takes considerably less time to check than what it takes to go over each report separately.

Things to keep in mind

- Each of the 3 major credit bureaus (Equifax, Experian & TransUnion) has different sources. Information for a certain lender or creditor may not appear for all of the 3 credit agencies, or may appear slightly different.

- It takes time for the information to be reported and reflect on your credit report. Your most recent financial activities may not be visible on your credit report.

Your credit report is divided into seven different sections:

| Consumer Information: | Used to identify you, and contains your personal information. |

| Consumer Statement: | Personal statements submitted by you to clarify a credit dispute or error. |

| Summary information: | Summarizes information about the different types of accounts you have. |

| Account History Information: | Detailed information about your accounts and your credit history. This section is very important because it strongly affects your overall credit score. You should check it thoroughly for errors and dispute any that you find. |

| Public Records: | Public information on any bankruptcies, tax liens, judgments against you etc. |

| Inquiries Information: | List of the Inquiries on your account made by potential lenders, creditors or employers within the last two years. |

| Creditor Information: | Contact information of all entities that you are either financially associated with or have received a copy of your credit report. |

A detailed sample 3-in-1 credit report breakdown follows, to walk you through the task of understanding and checking your report.

Note: A single bureau credit report looks very similar to a 3 bureau credit report, except for the fact that each row contains information from only one consumer reporting agency rather than all three.

Leave a Reply