Credit Bureau Information is Missing or Unavailable

If you were denied credit because of “credit bureau information is missing or unavailable“, It means that the lender refused you application because he can’t access your credit report(s), so he doesn’t know if it is safe to lend you money. Here is what you need to do…

If you were denied credit because of “credit bureau information is missing or unavailable“, It means that the lender refused you application because he can’t access your credit report(s), so he doesn’t know if it is safe to lend you money. Here is what you need to do…There may be several reasons for your credit information to go missing:

- On your application for credit, your SSN, birth date, name and/or address may have been entered incorrectly. If this is the reason, simply correct the mistake and apply again. You can also contact the creditor and verify that they have your correct details.

- Your credit report at the credit bureaus may be too “thin”. If your credit file history is shorter than 12 months, the credit bureaus report your information as “missing or unavailable”. In that case you need to wait until 12 month have passed and apply again.

- You may have no recorded credit history at all because you haven’t used credit yet. In that case you need to start building credit history.

- There may be error(s) in your credit report(s). In that case you need to pull your report(s) and check them

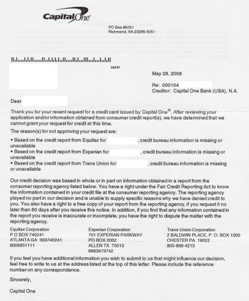

Under the Equal Credit Opportunity Act (ECOA), whenever you are denied credit/insurance/employment based on your credit, the creditor / insurer / employer must send you a letter (Adverse Action Letter) that specifies:

- The reason(s) you were denied.

- The name, address and phone number of the credit bureau that provided the information.

This entitles you to a free credit report from the credit bureau(s) whose details appear in the letter, on top of your free annual credit reports. If you were denied credit because of “credit bureau information is missing or unavailable” (or any other reason for that matter), use you privilege, order your free credit report(s) from the relevant credit bureau(s) and get down to the bottom of the problem.