Fico Score Range

Fico score range is 300-850, and is further divided to 6 risk categories: Excellent, Good, Average, Low, Poor & Bad. These risk categories determine your terms and whether or not you can get credit at all.

Fico score range is 300-850, and is further divided to 6 risk categories: Excellent, Good, Average, Low, Poor & Bad. These risk categories determine your terms and whether or not you can get credit at all.Fico credit score dominates the market, with more than 90% of creditors using it to make lending decisions and determining loan terms. Here is a breakdown of the 6 fico score range categories:

- 700–850 Excellent

- 680–700 Good

- 620–680 Average

- 580–620 Low

- 500–580 Poor

- 300–500 Bad

Fico Score Formula

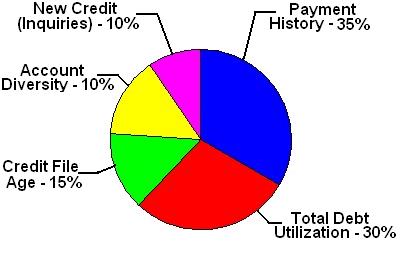

FICO score takes into consideration 5 factors:

See FICO Score Rating for more details.

Understanding Fico Scores

Because your Fico score is determined by the information that’s on your credit report, your actual Fico score at each of the 3 major credit bureaus (Equifax. Experian & TransUnion) can vary by 50-100 points.

As to further complicate matters, Fico credit score has actually 3 different versions, each used by different lenders for different purposes:

- The “Auto Enhanced” version is used by car dealers.

- The “Factual” version is used by mortgage brokers.

- The “Standard” version, which is a generic version of Fico and is the ONLY version available to consumers.

This means that every person has 9 different Fico scores! (See Understanding Fico Scores for more information).

How does your Fico influences you financially?

If you’re concerned about your Fico score and want to know how does it influence you financially, see What Are Good Credit Scores.