VantageScore 3.0

VantageScore 3.0 was launched in 2013 by the 3 credit bureaus (Experian, Equifax & TransUnion) in an attempt to better tackle the dominating FICO score.

VantageScore 3.0 was launched in 2013 by the 3 credit bureaus (Experian, Equifax & TransUnion) in an attempt to better tackle the dominating FICO score.The first versions of VantageScore initially ranged from 500 to 990, which confused users because it was almost impossible to compare the known FICO to the new VantageScore. For example, while a FICO score of 700 is considered good – a VantageScore 1.0 of 700 is mediocre at best.

So, in 2013 VantageScore 3.0 has adopted the FICO 350 – 800 scale. The latest VantageScore 4.0 released in 2017 maintains the same range.

VantageScore 3.0 Credit Tiers

Here’s how VantageScore 3.0 impact the lender’s decision:

| Range | Rating | % of People | Impact |

|---|---|---|---|

| 781 – 850 | Exceptional | 23% | Applicants most likely to receive the best rates and most favorable terms on credit accounts |

| 661 – 780 | Good | 38% | Applicants likely to be approved for credit at competitive rates |

| 601 – 660 | Fair | 13% | Applicants may be approved for credit but likely not at competitive rates |

| 500 – 600 | Poor | 21% | Applicants may be approved for some credit, though rates may be unfavorable and with conditions such as larger down payment amounts |

| 300 – 499 | Very Poor | 5% | Applicants will not likely be approved for credit |

VantageScore 3.0 Scoring Factors

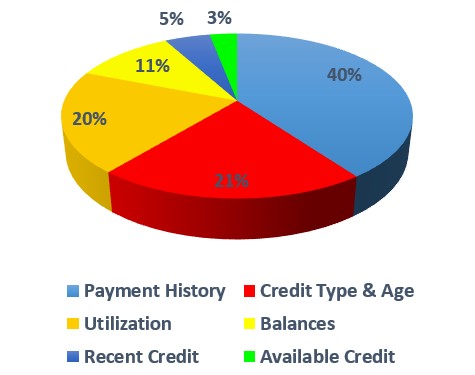

While VantageScore 3.0 adopted the FICO scale, the big difference between the two is how they weigh different data types:

Because of the different way they weigh data types, one’s VantageScore 3.0 is usually slightly lower than one’s FICO Score. While a VantageScore 3.0 above 661 is considered good, you’ll need a FICO Score of 670 or above to get you into the good tier.

VantageScore 3.0 vs FICO Score

For the key differences and how to convert VantageScore to FICO see this article.