Vantage Score

The Vantage Score was launched on March 2006 as a joint venture of the 3 major credit bureaus – Equifax, Experian and TransUnion.

The Vantage Score was launched on March 2006 as a joint venture of the 3 major credit bureaus – Equifax, Experian and TransUnion.The Vantage Credit Score promises to benefit consumers by being more accurate than the classic FICO score, and to provide less variance between the 3 credit report score from each bureau. Additionally, the three credit bureaus came up with a grading system that classifies a person’s credit category from A-F.

Challenging the classic FICO score, the new VantageScore system promises to solve consumers’ biggest complaint that they might get one credit score from Equifax – say 670, another score of 700 from Experian, and a 740 score from TransUnion. By using the exact same methodology and coding in calculating the Vantage score – the variance between the 3 credit report score from each bureau is supposed to be considerably smaller.

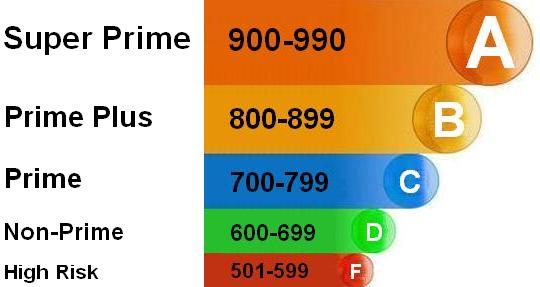

VantageScore Scale and Categories:

Compared to the numeric 300-850 FICO scale, the Vantage Credit Score scale ranges from 501 to 990, and is divided into 5 traditional easy-to-understand credit risk categories:

VantageScore formula breakdown:

While the exact details of how the new VantageScore is calculated are unknown, VantageScore has released the categories and proportions used. What contributes to a positive score in each category and to what degree particular data item affect the score is also unknown.

Classic FICO Vs Vantage Score

The new Vantage credit score is promised to benefit consumers by incorporating a few new features:

- VantageScores are said to be more predictive of credit risk because they look at more recent consumer behavior, as opposed to classic FICO model which is based on older consumer data.

- Vantage Score do better job than classic FICO by scoring more people and capturing a broader array of payment information. For example, if a consumer has utility bill payments being tracked or reported anywhere, that payment history is taken into account even though it’s not a traditional form of credit. This also contributes to the Vantage score’s better predictive capabilities.

- While classic FICO doesn’t score for the first six month, the Vantage score starts scoring as soon as the first consumer information item is registered in your credit file. This benefits infrequent and new credit users, as well as those with a thin credit file.

Here are the main differences between the Vantage Credit Score and the classic FICO:

| Vantage Score | Classic FICO | |

|---|---|---|

| Numeric Range | 501 – 990 | 300 – 850 |

| Credit Risk Categories | 5 available categories: A – Super Prime B – Prime Plus C – Prime D – Non-Prime F – High Risk |

None |

| Components Considered | Takes into account 6 components of your credit report: Payment History Credit Utilization Balances Depth of Credit Recent Credit Available Credit |

Takes into account 5 components of your credit report: Payment History Total Debt Credit Age Account Diversity Recent Credit |

| How new credit users are scored | Starts scoring immediately | Doesn’t score in the first 6 months of credit use |

| How “thin file” consumers are scored | Claims to score consumers with limited credit history more accurately by providing predicative scores | Consumers with limited credit history often cannot generate a credit score at all, or get inaccurate inflated score |

| Variance between different credit bureaus | Claimed to be small | May be significant for large number of consumers |

| Additional Differences | Gives more weight to recent credit activity, primarily on the last 24 months | Gives more weight to older credit history |

So should I monitor my FICO or my Vantage score?

To the moment of writing, the majority of banks, credit card companies and lenders are still using the classic FICO. Whether or not lenders will be willing to change to the new VantageScore system is yet to be seen.

Whether you choose to check your VantageScore, FICO, Credit Karma or any other score, what’s more important is that you monitor and keep track of it on a regular basis, not just once or twice. Combined with an annual review of your free government credit report, you can achieve valuable insights into how to adjust your credit habits, achieve a healthy credit score and better protect yourself from credit fraud and identity theft.