Identity Theft Facts

According to the 2012 identity theft facts just released by the FTC, more than 12 million people fell victim to financial identity theft this year. This equates to 1 victim every 3 seconds! The mean fraud amount per victim stands at $4,930.

According to the 2012 identity theft facts just released by the FTC, more than 12 million people fell victim to financial identity theft this year. This equates to 1 victim every 3 seconds! The mean fraud amount per victim stands at $4,930.For the 12th year in a row, identity theft complaints topped the list, and the overall number of reported identity theft frauds in 2012 has increase by 12% compared to the previous year.

Approximately 15% of all cases of identity theft are cases of new account origination. This form of identity theft occurs when a criminal opens credit in another individual’s name.

Here are some interesting 2012 identity theft stats:

- Consumer fraud costs increased in 2012

The average consumer paid $4,930 related to the fraud (the median amount was $569). Of those reported a payment amount, 51% say they paid nothing at all and 18% paid more than $1,000. This includes costs incurred by the victim towards payoff of any fraudulent debt as well as fees (legal or otherwise) to resolve fraudulent claims. - New account fraud was most damaging

New account fraud (in which new accounts have been opened without the victim’s knowledge or consent) was responsible for the greatest fraud amount – $17 billion. - “Friendly Fraud” is on the rise

Friendly fraud incidents (which occurs when the identity thieve is known to the victim) have increased in 2012 by 7 percent.Consumers between the ages of 25-34 are most likely to be victims of friendly fraud, with 41 percent of victims in this group reporting their SSN has been stolen.

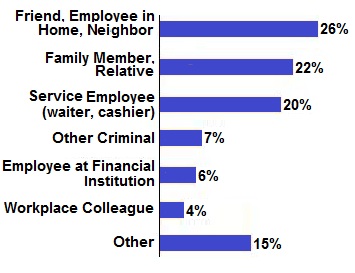

Who Steals Your Identity

Additional identity theft stats from the FTC

The Federal Trade Commission (FTC) has received over 1.8 million complaints on 2012, 279,156 of which were identity theft complaints. It has been the subject that most concerned customers for 12 straight years.

According to the FTC, approximately 3 out of 4 ID theft victims do not know the source of the crime. The most popular type of identity theft involved stealing victims’ identities in order to apply for federal benefits such as Social Security payments. Also popular were credit card cases in which consumers unwittingly provided thieves with the ability to steal their existing credit card data. The thieves were then able to make unauthorized credit card purchases with this information.

Return from Identity Theft Facts to Identity Theft Page

Return from Identity Theft Facts to Credit Report 101 Home Page